??????VA MORTGAGES – VETERANS & ACTIVE MILITARY??????

Salutations to all veterans and military members currently serving. I appreciate your service.

Get the ideal mortgage for you with the help of a licensed mortgage broker.

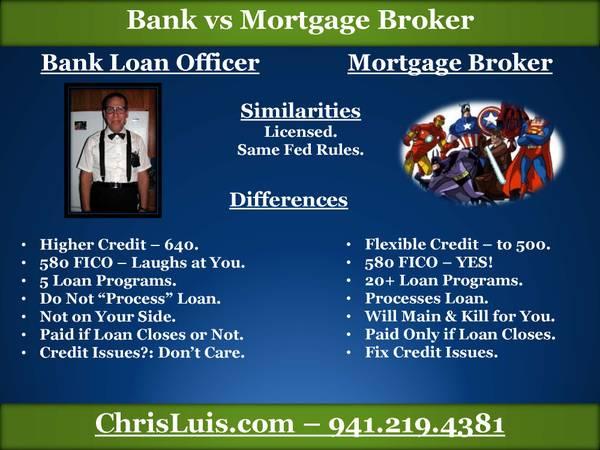

Banks offer limited programs. High Scores Needed. No leeway.

Mortgage Brokers have 20+ Programs. Low Scores may be OK. Many options and leeway. Even No Income Verification Mortgages.

The Management of My Go To Lender are all Veterans. It offers among the lowest VA rates compared to other lenders.

Call to Get Started. Or go to my site and fill out an application.

The Veterans Administration guarantees the loan. It is for to veterans, active military, and surviving spouses. The VA does NOT approve your loan. It is underwritten by the lender you choose.

A VA loan is the best program available.

You need your DD214 and your VA Certificate of Eligibility.

I work with lender, headed by veterans, that offers the lowest VA interest rates in the business.

To get a mortgage, you need credit, money, and a loan officer.

Credit means 3 items:

1. A credit score of 500…BUT better at 580.

2. Current or open credit items such as credit cards or loans – Just as Important.

3. NOT terrible credit for the last 2 years.

There is a difference between a low credit score and poor credit.

Terrible Credit is:

1. a car repossession the last 12-24 months,

2. several late payments on credit cards,

3. student loans in default or in collections,

4. child support in collections

5. A bankruptcy or foreclosure in the last 2-3 years

6. Missed payment on credit cards or auto loans in the last 1-2 years Following a Bankruptcy.

You need perfect credit to go to USAA, Wells Fargo, Veterans United, or your credit union. 620-640 score. And load you up with one request after another.

With my lenders, you can go down to 500, I closed one VA Mortgage and the Vet had a 517 Credit Score.

Second, documented income. This can be pay stubs (military pay), w-2s, or tax returns if you are self-employed or VA benefits.

Third, a loan officer to figure this process for you and get you to the right lender.

I will pay for your appraisal, saving you $550. Get your Certificate of Eligibility. And draft all the letters you need to write.

OTHER HIGHLIGHTS

$0 down payment. $0 mortgage insurance.

Use your benefit over and again.

Your benefit never expires.

Surviving spouses are eligible.

VA Rates are lower than other programs.

VA loans are available from almost all lenders. But it makes a big difference who approves you.

Buy, refinance, or take cash out.

Lenient guidelines for lower credit scores, bankruptcy, foreclosure

You can buy many types of properties. Single-family home. 1 to 4 units. Manufactured homes. Condos.

STEP 1: GET PRE-APPROVED.

HOW: call me, or go to my site and fill out an application at ChrisLuis.com

More INFO?: write me an email or text me.

A Pre-Approval Letter is the first step in house hunting. Most realtors will not show you homes without one.

For a Pre-Approval Letter, you need to have your credit pulled and have your income verified. Income verified is recent paystubs and 2 years of w-2’s. Or your VA Award Letter.

SAME DAY PREAPPROVALS.

ChrisLuis.com

941-219-4381

CALL OR APPLY IN LINE NOW, BE HOUSE HUNTING in 1 HOUR

Offered in Florida, Texas & Pennsylvania.

Other loan programs available: FHA, Conventional, Investors, Bank Statements, and more.

#VeteranLoans

#VAMortgages

#Veteran

#MortgagePreapproval

#USARMY

#USNAVY

#USMARINES

#USAIRFORCE

NOTICE REQUIRED BY LAW: This is not a commitment to make a loan. Loans are subject to credit and money qualifications. Not everyone receives a final approval. Approvals subject to underwriting guidelines, interest rates, and program guidelines. 3rd Party lenders can change programs without notice. Final approval decided by the 3rd Party Bank.

Be the first to review “??????VA MORTGAGES – VETERANS & ACTIVE MILITARY??????”

You must be logged in to post a review.

Reviews

There are no reviews yet.