?????????ALL TYPES OF MORTGAGES??????

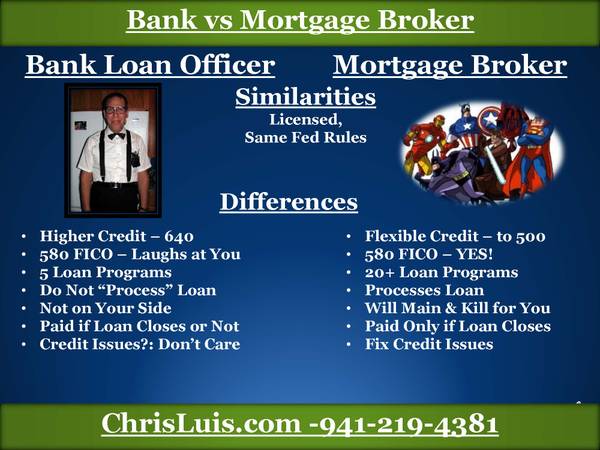

Let a Licensed Mortgage Broker Find the Right Mortgage for You.

Banks have @5 programs. 640 Score. All need income documents. Tax returns or pay stubs.

Mortgage Brokers have 20+ Programs. 580 Score may be OK. Many options to qualify. Even No Income Verification Mortgages.

Customers call me their Favorite Mortgage Broker.

Call to Get Started!

To get a mortgage, you need Credit, Money, and a Loan Officer.

Credit means: a 580 Credit Score. Active Credit. Such as credit cards or loans. No active credit then your odds are low. Not Terrible Credit the last 2 years. A 580 Score is low. It cannot be poor credit.

Terrible Credit means: A car repossession the last 12-24 months. Student loans or child support in collections. A bankruptcy or foreclosure in the last 2 years. A Low Score & Several Lates on auto loans the last year. No Open Credit Items.

Money means Documented Income: pay stubs, w-2s, or tax returns.

Self-Employed and taxable income is low? Use bank statements deposits to qualify.

Or, go with a No Income Verification with 20%-35% Down plus Closing Costs in the bank.

If you have Credit and Money, you may already qualify.

A Mortgage Broker Officer figures this for you.

Here is the list of some of my programs:

Conventional: 620 Score with & near perfect credit. 3%-5% Down

FHA: 580 Score, 620 is better. 3.5% Down. 10% down with Score under 580.

USDA: 580 Score. 0% Down.

VA: 560 Score. 0% down.

Self Employed: Score 580. Bank Statement Deposits to qualify. 10%-25% Down, depending on score.

Investors: 620 Score. 20% Down. Qualify on Rental Income.

Others: Fix & Flip. New Construction (build own). Condos. Manufactured Homes. Commercial.

No Income Verification Mortgages. $$ in bank for Down, Closing Costs & Reserves. See slide for Down Payment Guide.

Interest based on Score, Loan Program and Loan Size.

Not all applicants qualify.

Step 1: Get a Pre-Approval Letter.

Many realtors will not show you homes without one.

Pre-Approval Steps: have credit pulled, Official Mortgage Credit Report. This verifies your mortgage programs. Income verified (pay stubs and w2s) to determine loan size. Self-Employed need Tax Returns for traditional loans.

Start now to get Pre-Approved. Same Day Pre-Approvals.

Chris Luis. 941-219-4381. chris@chrisluis.com.

Or, go to ChrisLuis.com and fill out an application.

I work with federal and state licensed banks.

Mortgage Broker License NMLS#1159714.

Mortgage Loan Officer License NMLS#888571.

Licensed by the Texas Department of Savings and Mortgage Lending. The Florida Office of Financial Regulation. And, Pennsylvania Department of Banking and Securities.

#firsttimehomebuyer

#mortgagebroker

#HomeLoans

#mortgages

#USDA

#VAMORTGAGES

#FHAMortgages

#SelfEmployedMortgages

#NoIncomeVerificationMortgages

NOTICE REQUIRED BY LAW: This is not a commitment to make a loan. Loans are subject to credit and money qualifications. A property evaluation, equity in the home, and final credit approval. Not everyone receives a final approval. Approvals subject to underwriting guidelines, interest rates, and program guidelines. 3rd Party lenders can change programs without notice. Final approval decided by the 3rd Party Bank.

Be the first to review “?????????ALL TYPES OF MORTGAGES??????”

You must be logged in to post a review.

Reviews

There are no reviews yet.